Bitcoin Margin Trading Bot

Automated, secure, and easy to use AI Enhanced Bot designed for Cryptocurrency Margin trading. Adjust Stop loss, Trailing stops, and make the most out of our specialized Crypto Signals.

Easy To Use

SIGN UP

Easily register with your email

ADD YOUR WALLET

Connect your exchange Account

ENJOY PROFITS

The AI Bot trades and makes profits

Bitcoin Margin Trading Bot

Automated, secure, and easy to use AI Enhanced Bot designed for Cryptocurrency Margin trading. Adjust Stop loss, Trailing stops, and make the most out of our specialized Crypto Signals.

Supported Exchanges

Bitcoin

BTC

67373.2 $

Ethereum

ETH

1941.93 $

Bitcoin Cash

BCH

569.9 $

Litecoin

LTC

53.33 $

Ripple

XRP

1.39 $

How AI Auto Trading Robot Works?

After each hourly candle closes, depending on a user's status, our AI decides how much and in what direction to trade. Our AI may decide to hold in the current Position (depending on how many other open positions are available for a user), Invest more to the current position or close on a percentage of the current position.

Is It Really Free?

PlayOnBit offers a free plan for users to experience some of the capabilities of our highly advanced AI Enhanced Trading Bot. The bronze plan is a great way to test our Bot's functionality. The premium plans, will furthermore add new features and functionalities to your customized bot. You can upgrade from the bronze plan at any time.

Automated Profit Making

PlayOnBit allows you to set up your own personal trader bot. That means you can make money while you sleep in cryptocurrency markets that never sleep! Our easy to use bot even allows amateur traders to take advantage of volatile markets by taking the emotion out of the decision making processes. Cryptocurrency Investment has never been this easy.

Read on Blog

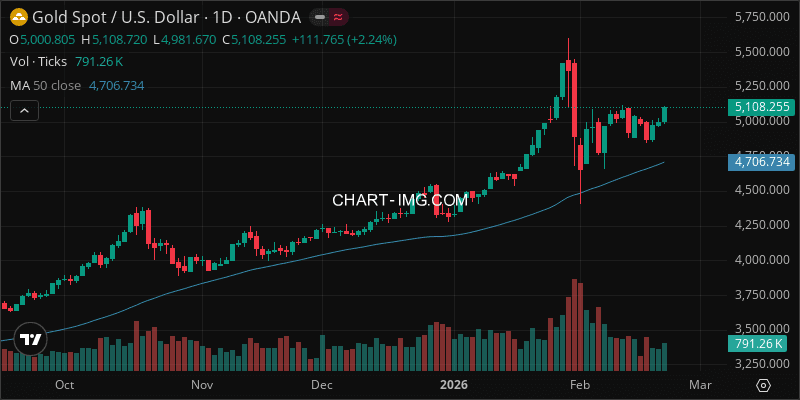

Gold Weekly Report (XAUUSD): 2026-02-15–2026-02-22 | Macro Drivers

Gold (XAUUSD) rebounded from mid‑week lows to close near the weekly high while DXY strength and higher yields limited further gains. Key catalysts were the FOMC minutes and a heavy US data slate including GDP and core PCE.

2Y/10Y spread explained: recession signal or noise?

Explains what the 2Y/10Y yield spread measures, why inversions attract recession risk attention, and how traders use the indicator alongside other signals in forex and crypto markets.

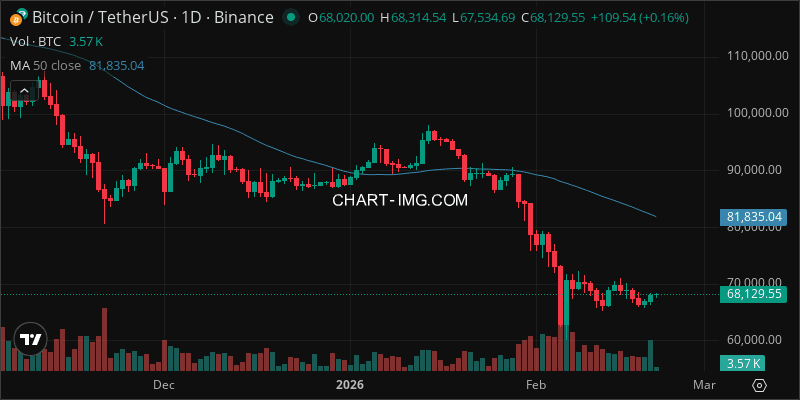

Bitcoin Weekly Report (BTCUSDT): 2026-02-14–2026-02-21 | Funding Shifts

Weekly BTC dataset summary for 2026-02-14 to 2026-02-21: spot closed near $68.18k, perp basis -32.6, funding ~0.000025, OI ~81,130; price ranged ~65.6k–70.1k amid ETF outflows and mixed macro signals.